Tuesday, 20 July 2021

Tuesday, 20 July 2021

Consumer behavior has been altered after more than a year of disrupted lives, social distancing and shuttered stores and restaurants. They have enjoyed new conveniences with online shopping, with many businesses pivoting their core businesses to cater for their consumer needs.

As borders begin to re-open and gathering restrictions ease up around the world, we can expect to see more travelling, in-store purchases and dining in restaurants, but analysts caution that post-pandemic consumers might have different expectations from businesses.

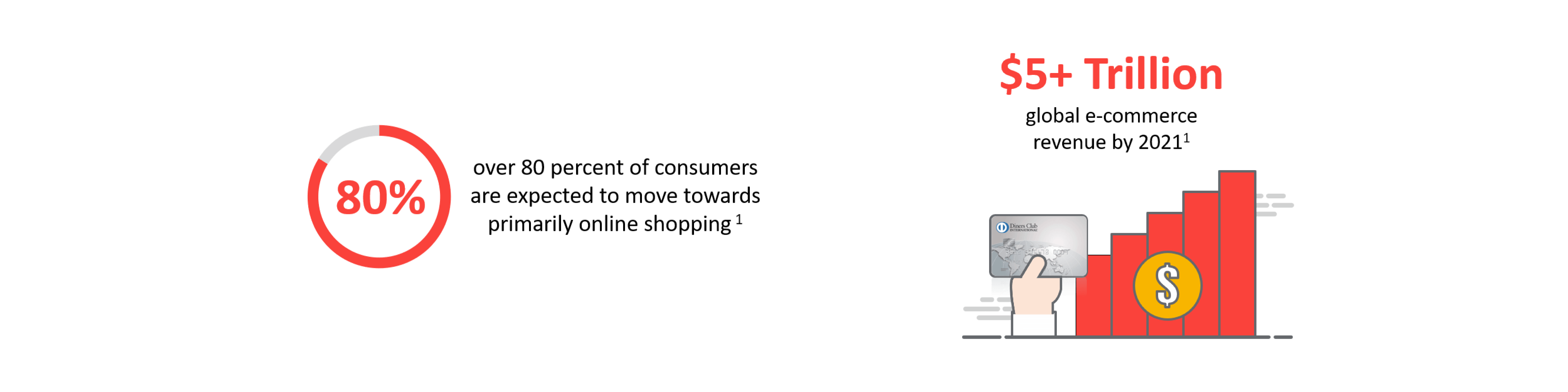

The online shopping and ordering experiences have allowed consumers flexible ranging from searching for an item, delivery and even the payment methods accepted. Merchants should expect to see differences in the way their customers shop. While many customers do look forward to returning in-store, their mix of preferences has shifted. Indeed, over 80 percent of consumers are expected to move towards primarily online shopping, this would expand global e-commerce revenue by more than 22 percent to over $5 trillion in 2021, according to a report by 451 Research.1

While these shoppers might, be eager to embrace a return to in-person shopping, they bring along their expectations from the online channel. Merchants will need to adapt to these new consumer habits. Many are responding with plans for significant new digital investments given the changing environment.

But merchants need to move quickly. Two-thirds of U.S. consumers surveyed told 451 Research that they would return to indoor shopping within three months after COVID-19 restrictions were lifted, and some 88 percent said that having a negative experience either online or in-store would make them less likely to shop with that brand or retailer again.2

To win this business, merchants need to understand the new consumer and maintain their loyalty in a post-pandemic world. They will need to build a seamless experience across both physical stores and e-commerce websites, so that a customer who has been shopping at a retailer’s website will have a comparable experience when shopping in-store.

Most immediately, consumers increasingly want more control over how they shop and how they spend—a convenience they have discovered increasingly online. They want to pay for purchases the way they want, with the payment method they want, and on the device they want. Merchants need to be prepared to offer the payment methods that consumers have come to expect, including the structured repayments of buy now, pay later plans, credit and microloan apps, reward programs and loyalty programs. Many consumers also discovered that subscription delivery models for both products and services—using card-on-file payment accounts—added convenience and predictability. With many consumers satisfied with these regular deliveries 3 for everything from meal kits to razors, merchants must consider how to adapt to this alternative trend.

Consumers are increasingly used to easy and convenient checkouts online—and now they want them in-store. One in three consumers say the convenience of self-checkouts, for example, would encourage them to shop in person.4 When they are in stores, customers say they want to spend less time hunting for products and prefer the efficiency of self-service when possible. One in four consumers say a self-service kiosk, telling them where to find merchandise, would encourage them to shop at retail locations.

Flexible fulfillment strategies are also becoming a necessity to create a seamless shopping experience for digital consumers returning to brick-and-mortar.4 Even with customers returning in-store, many will continue to prefer options such as reserving online and picking up in-store, or buying online and returning in-store. Two out of five consumers said that a convenient shopping experience, enabled by these types of channel fulfillment options, would encourage them to shop at a particular location upon reopening.4 In fact, removing friction in the shopping experience is “the most fundamental aspect of improving customer experiences,” according to findings by 451 Research.4

Personalization will grow in importance. With digital commerce tools that respond to individual shopping histories—coupons, discounts and recommended products—a similar level of personalization is key for shoppers who return in-store. Surveys show that loyalty programs increase both the frequency of visits and the level of sales, and loyalty is important both online and offline. Two in five consumers said personalized coupons would encourage them to shop in-store more often, while 54 percent of retailers said they were well-placed to offer a personalized shopping experience.4

Controlling their finances will also remain key for consumers. The use of debit cards, in particular, has seen a significant upswing. In fact, consumer usage of these types of payment rose 8.6 percent in the second quarter of 2020 over the same period in 2019, as consumers sought to control their borrowing in the face of economic unknowns.5 The use of reloadable prepaid cards also increased. For merchants, this means ensuring that all forms of payment and all card brands are available for consumers who want this flexibility. Indeed, one survey found that 85 percent of primary card members* find it important to be able to use their primary card wherever they shop.6

Given all these changes, “merchants are responding to consumer demand by offering more payment options at checkout,” concluded a report from Aite.4 Surveys further showed that planned investments by merchants for these new digital capabilities—for both online and in-store transactions—are expected to increase. With online shopping projected to rise more than 20 percent in 2021 over 20208, retailers should be prepared to invest further to provide this seamless interaction and use their brick-and-mortar locations as an experience with which to leverage online sales—and vice-versa.9 Because consumers now expect this new approach, businesses need to continually invest in capturing and synthesizing data from areas such as past purchases, behavioral data and stated preferences to create personalized, contextual interactions with consumers.8

With the recent and unprecedented changes experienced by the entire retail sector, shoppers are emerging from their pandemic-induced seclusion demanding a seamless shopping experience from computer to smartphone to brick-and-mortar stores. The simplicity and convenience of online shopping, with products both easy to find and easy to buy, have led customers to expect a wide array of new options. As such, they have increasingly come to look for frictionless checkouts and a multiplicity of payment methods, from the acceptance of more cards to flexible instalment plans. They also have begun seeking the personalized experiences they have been enjoying online.

These shifts in the marketplace mean that merchants today need to be increasingly agile, adapting to these changes in shopping habits to give customers the experience they now demand. By understanding these new expectations, merchants can win back the in-store consumer and set themselves up for loyal, repeat customers for years into the future.

* Primary cardmembers are defined as respondents who use Discover Card more than other cards.

1 451 Research, January 2021. 2021 Technology Preview – A pivotal year for IT in preparation for a post-pandemic ‘new normal’. Viewed 21st March 2021.

2 451 Research, February 2021. The return to store in a digital-first, post-pandemic world. Viewed 22nd March 2021.

3 Mercator Advisory Group, December 2020. Subscription Economy Accelerates as Stay-At-Home Lifestyle Spurs Demand. Viewed 25th March 2021.

4 451 Research, February 2021. The return to store in a digital-first, post-pandemic world. Viewed 22nd March 2021.

5 Mercator Advisory Group, September 2020. Credit Card Products for a new User Environment. Viewed 17th March 2021.

6 C+R Research Study of 1,808 Discover Cardholders, August 2020, commissioned by DFS Services LLC.

7 Aite, December 2020. Payments Modernization in Retail Banking. Viewed 24th March 2021.

8 451 Research, January 2021. 2021 Technology Preview – A pivotal year for IT in preparation for a post-pandemic ‘new normal’. Viewed 21st March 2021.

9 451 Research, February 2021. The return to store in a digital-first, post-pandemic world. Viewed 22nd March 2021.

The information provided herein is sponsored by Discover® Global Network. It is intended for informational purposes and is not intended as a substitute for professional advice.