area-grey

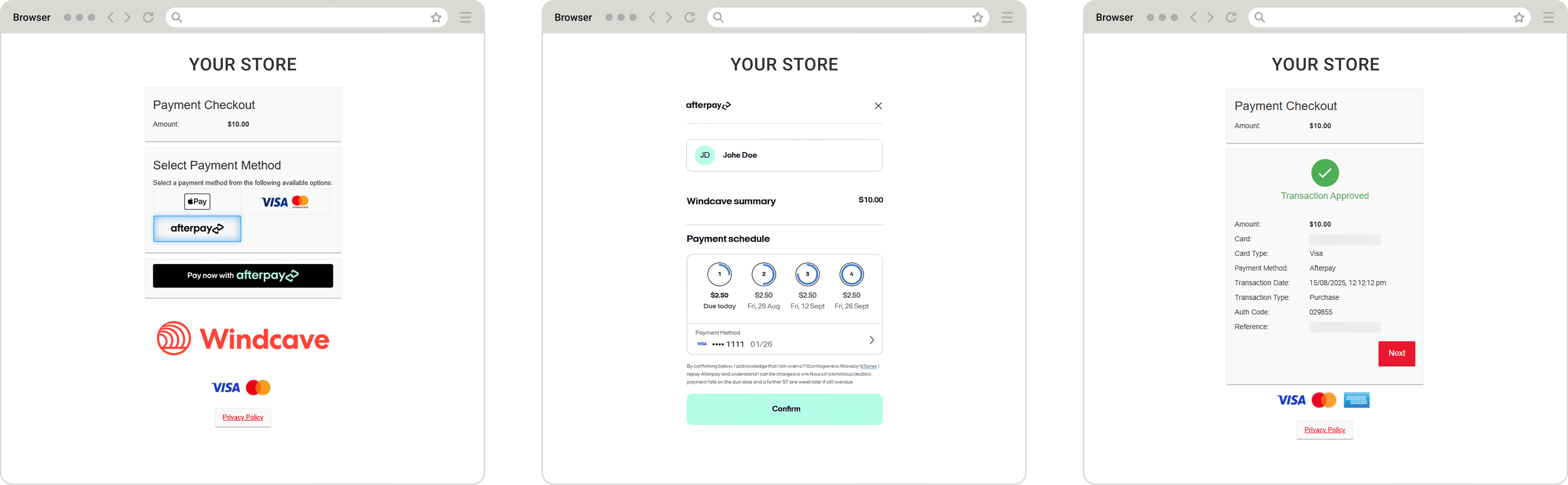

Afterpay/Clearpay

Afterpay (referred to as Clearpay in the UK) is a simple payment solution that enables merchants to offer a buy now, pay later service, either by paying in installments over 6 weeks interest-free (Pay it in 4) or over 6 or 12 months with interest (Monthly Payments, US Only).

Benefits

Expanded Reach

Connect with Afterpay’s large and growing customer base, especially Millennial and Gen Z consumers who prefer flexible payment choices.

Higher Value

Flexible installment payments can encourage larger baskets and repeat purchases, helping merchants lift their average order value.

Upfront Payment

Receive funds promptly while Afterpay assumes repayment risk, giving merchants peace of mind.

Seamless Integration

Easily add Afterpay through Windcave’s Hosted Payment Page (HPP) and Drop-in solutions, alongside existing methods.

area-grey

Key Capabilities

area-grey

Payment Category

Buy Now Pay Later

Supported Countries

Australia, Canada, New Zealand, United Kingdom, United States

Recurring Payments

Not supported

Refund

Supported

Supported Solutions

In-store, Online, Unattended

Processing currencies

AUD, CAD, GBP, NZD, USD

Settlement Timeframe

Controlled by Payment Method