A Recent Shift in Consumer Demand Has Led to Dramatic Increases in Contactless Transactions

Contactless & QR Payments: A Merchant's Opportunity

Monday, 11 October 2021

Monday, 11 October 2021

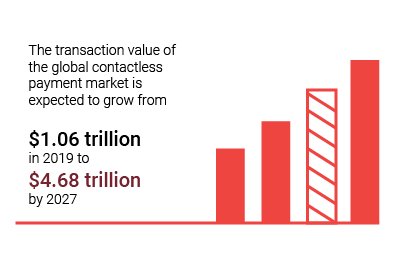

The popularity of contactless payments is soaring - especially in the current environment. Contactless payments is already on the rise thanks to its speed and simplicity of the checkout experience. Consumers are embracing contactless cards, QR scanning, mobile wallets and NFC wearables like smart watches. We take a look at some statistics to see how contactless payments have changed consumer behaviour.

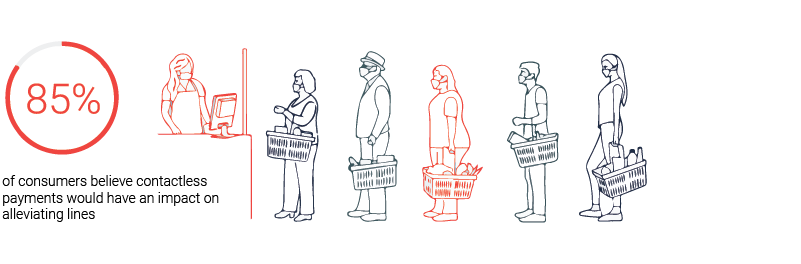

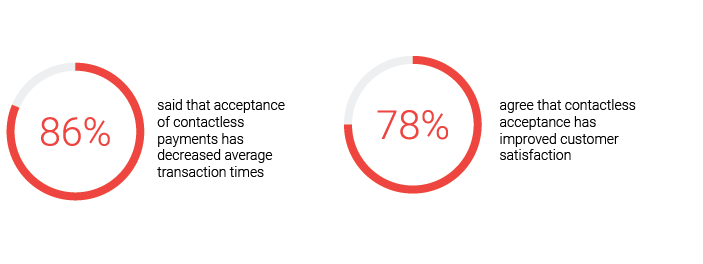

Combating Long Lines Continues To Be a Top Priority for Merchants

Enabling Contactless Payments Is Essential to Meeting Consumers' Desire for Convenience

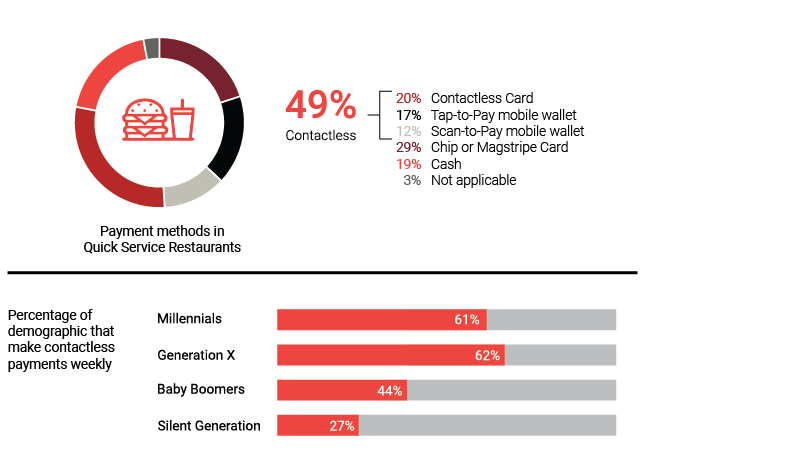

Contactless Outpaces Other Payment Methods but Varies Among Demographics

Merchants That Accept Contactless Payments Experience Favorable Business Outcomes

As consumers' preference shifts increasingly to contactless payment options, a growing number of merchants are adapting to accept touch-free payment card, mobile apps and QR code alternatives

With the ability of QR codes to provide users with videos, games, recipes, gifts, coupons, and personalized communications, the use of QR is extending to other countries Outside of China these countries had the largest retail sales using QR code transactions in 202112

References:

Discover Global Network: Contactless & QR payments study. Viewed 20 September 2021.